Toews Asset Administration CEO Phil Toews shares insight on investing amid relocating markets.

Markets are performing like the world wide financial state is headed for a slowdown, in accordance to Financial institution of The usa.

Unparalleled quantities of fiscal and monetary stimulus have been unleashed into the international overall economy, yet reopening trades and other trades indicating enhanced urge for food for danger-taking are looking at a W-formed recovery, indicating momentum is petering out.

The tale of the tape is “recessionary,” wrote Michael Harnett, chief financial commitment strategist at Lender of The us, pointing to the motion in U.S. Treasurys, commodities and world equity marketplaces.

In the U.S., the produce curve when measured by the five-yr and 30-year yields, fell to 110 basis factors this 7 days, the flattest in a 12 months. A flatter produce curve suggests advancement is likely to sluggish in the months forward.

Huge Revenue Administrators RATCHET UP Anticipations FED WILL ANNOUNCE TAPER THIS Yr

At the similar time, international stock marketplaces, excluding U.S. technology shares, are unchanged in excess of the past 8 months, in accordance to Hartnett. Commodities like oil, copper and palladium, which benefit from a developing overall economy, have fallen up to 23% from their the latest peaks.

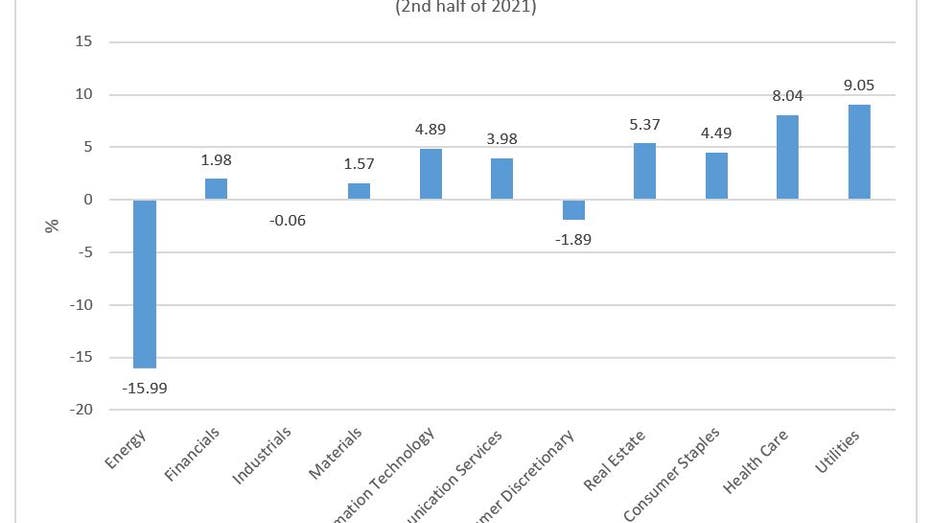

Within the S&P 500, the defensive sectors, like utilities, wellbeing treatment, REITs and purchaser staples, are among the the leading performers through the next 50 % of this yr.

Dow Jones Current market Knowledge, FactSet

The cautious trade comes as U.S. purchaser self-confidence plunged to 10-year small, a chip lack has prompted a sharp fall in world-wide vehicle generation, and China’s development is threatened by additional lockdowns aimed at slowing the spread of COVID-19.

This as the Federal Reserve minutes introduced Wednesday signaled the central lender could start to taper its asset buys as before long as this calendar year.

All of this sets the phase for the “increasing threat of [an] autumn ‘flash recession” that is likely to be revealed in a sharp fall in global obtaining professionals indexes, Hartnett wrote.

Hartnett warns traders of damaging returns for shares and states traders really should individual good quality defensive names into year close. Nevertheless, his lengthy-expression secular check out is that inflation will get out more than deflation.

Analysts elsewhere on Wall Road are far more optimistic.

Goldman Sachs before this month lifted its 12 months-close S&P 500 rate target to 4,700, up from 4,300, because of to its expectation of “more powerful income development and much more pre-tax gain margin enlargement.”

It warned that uncertainty all over fiscal and monetary policy would stir marketplace volatility later on this 12 months.

Mark Haefele, chief investment decision officer at UBS Worldwide Wealth Administration, agrees.

GET FOX Organization ON THE GO BY CLICKING Below

He thinks traders need to “put together for volatility” but that “potent nominal development and extraordinary plan guidance represent ‘zero gravity’ problems that are very likely to persist for the up coming 6 to 12 months.”

Haelfe says the S&P 500 is most likely to reach 5,000, or 13% earlier mentioned recent amounts, by the end of 2022.