Tiny organizations with revenues up to $2.5 million and enduring economic hardship due to COVID-19 are inspired to utilize for grants of up to $50,000.

Governor Kathy Hochul has introduced modifications to New York State’s $800 million COVID-19 Pandemic Tiny Small business Recovery Grant Application that will permit more smaller businesses to use for funding. Starting quickly, organizations with revenues up to $2.5 million can use for grants, up from the prior threshold of $500,000. Also, the limitation for corporations that gained Federal Paycheck Security System financial loans has been increased from $100,000 to $250,000.

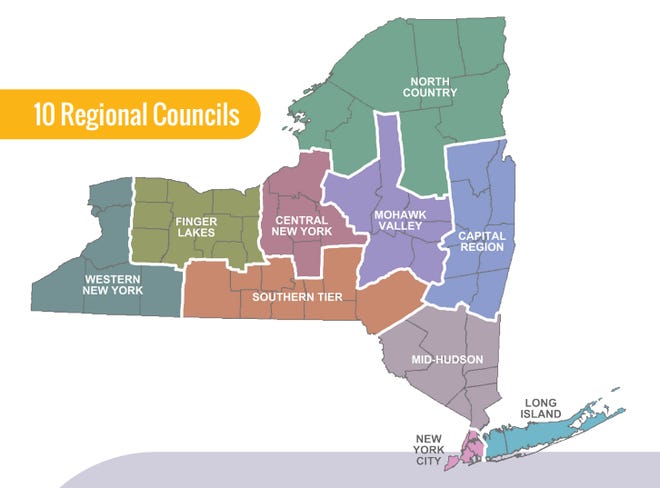

Introduced in June, the plan at first targeted on little and micro-corporations across New York Point out, which were largely remaining out of federal company recovery initiatives. Empire State Progress (ESD) and its partners have worked challenging to make sure that these firms have the specialized assistance — including advice for the duration of the software approach and help to prevail over language obstacles — they want to be initially in line for this program. To day, far more than $48 million has been awarded to around 2,380 tiny and micro-businesses in all 10 regions of the point out. The modifications introduced these days assure additional tiny organizations can far more quickly obtain funding as a result of the system.

ESD and Lendistry, the minority-led Neighborhood Growth Money Establishment that was picked to administer the system, will go on to take and overview applications. All present candidates — those who have not completed their apps, have not uploaded documents, or have incomplete documentation — are encouraged to finalize their purposes as soon as achievable. Previously ineligible little businesses may start implementing these days, and these applications will commence staying processed on Wednesday, September 8. Extra data, which include system recommendations and the grant application, can be discovered below.

Grants for a bare minimum award of $5,000 and a utmost award of $50,000 are calculated dependent on a New York Condition business’ once-a-year gross receipts for 2019. Reimbursable COVID-19 related fees should have been incurred involving March 1, 2020 and April 1, 2021 and can involve payroll expenses industrial lease or mortgage payments for New York State-primarily based home payment of neighborhood property or college taxes insurance policy and utility costs fees of personalized defense equipment vital to protect worker and buyer well being and safety expenses for heating, ventilation, and air conditioning, or other machinery and gear and materials and elements vital for compliance with COVID-19 wellness and protection protocols.

ESD has created and maintains a web-site, YSBusinessRecovery.ny.gov, that highlights the several resources out there to support modest enterprises seeking pandemic aid. The web-site is consistently up-to-date as far more particulars and funding details gets accessible.