Table of Contents

What GAO Discovered

Financial Harm Catastrophe Bank loan (EIDL) candidates and recipients diverse in conditions of organization measurement, decades in operation, and industry, primarily based on GAO’s investigation of Compact Enterprise Administration (SBA) details from March 2020 via February 2021:

- Enterprise dimensions. A majority of EIDL applicants (about 81 p.c) and EIDL recipients (about 86 %) have been smaller corporations (10 or less employees).

- Years in procedure. A greater part of EIDL candidates (about 63 per cent) experienced been in operation for considerably less than 5 yrs. Nevertheless, corporations in procedure for far more than 5 a long time gained the greater part of total EIDL financial loan pounds and had greater approval premiums in contrast to newer firms.

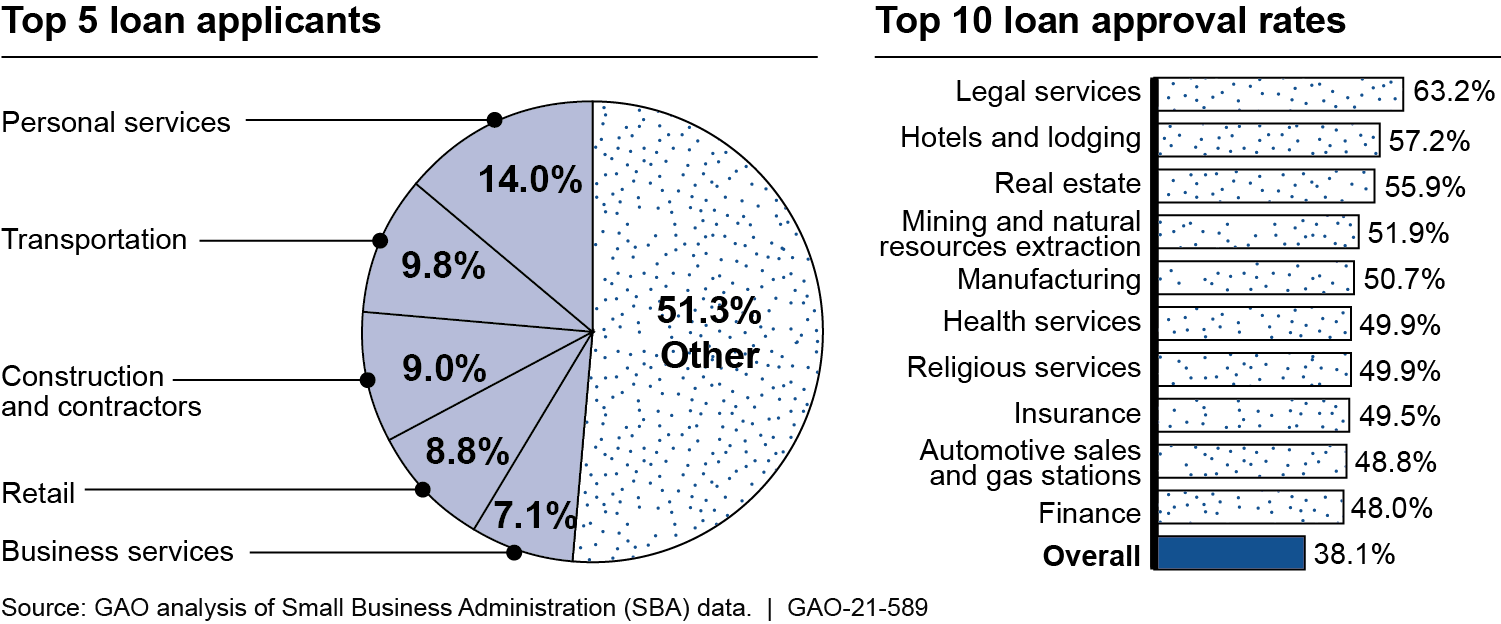

- Market. Companies in the personal solutions and transportation industries made up the most significant share of candidates, although those in the authorized providers and lodging industries ended up permitted for financial loans at the best charges (see determine).

Best Loan Applicants and Acceptance Prices by Business Market

In addition, small organizations in counties with larger median home profits, much better world-wide-web obtain, and much more assorted populations generally gained far more loans per 1,000 enterprises and much larger financial loans.

EIDL candidates have confronted a range of problems, according to candidates and other company stakeholders GAO interviewed concerning August 2020 and February 2021. For illustration, applicants from 5 dialogue teams and a number of stakeholders cited deficiency of information and uncertainty about application position as main concerns. In addition, until February 2021, SBA did not deliver significant data to prospective candidates, these types of as limitations on personal loan amounts and definitions of certain software terms. Lack of important application facts and software standing place tension on SBA’s resources and negatively influenced applicants’ knowledge. For illustration, SBA’s shopper provider line skilled connect with surges that resulted in extensive wait times, and SBA’s details confirmed that 5.3 million apps have been duplicates. SBA’s planning paperwork explain in typical terms the community outreach to be done next disasters, but they do not element the variety or timing of the information to be furnished. Creating and employing a thorough conversation tactic that incorporates these specifics could make improvements to the quality, clarity, and timeliness of facts SBA offers to its applicants and source companions next catastrophic disasters.

GAO’s ongoing review of the EIDL program linked to COVID-19 has uncovered that the plan is vulnerable to supplying funding to ineligible and fraudulent candidates. For instance, as GAO reported in January 2021, SBA had accredited at minimum 3,000 loans totaling about $156 million to businesses that SBA guidelines point out have been ineligible for the EIDL method, these types of as real estate builders and multilevel entrepreneurs, as of September 30, 2020. In addition, GAO identified that among Might and Oct 2020, above 900 U.S. economical institutions filed additional than 20,000 suspicious exercise studies related to the EIDL software with the Economical Crimes Enforcement Community. Even further, GAO’s analysis of 51 Section of Justice instances involving fraud prices for EIDL financial loans as of March 2021 discovered that these situations associated identity theft, false attestation, fictitious or inflated staff counts, and misuse of proceeds.

Over the system of its COVID-19 response, SBA has designed some adjustments to tackle these hazards. For case in point, beginning in June 2020, SBA took steps to strengthen loan officers’ capability to withhold funding for candidates suspected of fraud. Nonetheless, SBA has not but implemented tips GAO has previously designed to handle EIDL application challenges.

- In January 2021, GAO encouraged that SBA conduct data analytics across the EIDL portfolio to detect probably ineligible and fraudulent apps (GAO-21-265). SBA did not agree or disagree with this recommendation. On the other hand, in May well 2021, SBA officers mentioned the company was in the process of producing evaluation to use sure fraud indicators to all application facts.

- In March 2021, GAO proposed that SBA (1) put into practice a comprehensive oversight approach to identify and answer to threats in the EIDL software, (2) carry out and document a fraud threat assessment, and (3) develop a technique to deal with the program’s assessed fraud threats on a steady basis (GAO-21-387). SBA agreed with all three suggestions. In Could 2021, SBA officials stated that the company had begun to evaluate fraud hazard for the plan.

Absolutely applying these suggestions would enable SBA to safeguard billions of bucks of taxpayer cash and increase the operation of the EIDL program.

Why GAO Did This Analyze

Amongst March 2020 and February 2021, SBA presented about 3.8 million reduced-fascination EIDL financial loans and 5.8 million grants (known as advancements) totaling $224 billion to help compact corporations adversely affected by COVID-19. Borrowers can use these very low-interest financial loans and developments to pay for operating and other costs.

The CARES Act incorporates a provision for GAO to check cash provided for the COVID-19 pandemic. This report examines, amongst other aims, the properties of plan applicants and recipients the problems EIDL applicants professional and the extent to which SBA has addressed them and the techniques SBA has taken to tackle hazards of fraud and provision of money to ineligible applicants.

GAO reviewed paperwork from SBA, an EIDL contractor, and two of its subcontractors. In addition, GAO analyzed personal loan application facts, performed five dialogue groups with candidates, and interviewed employees from SBA, 6 Smaller Business Growth Centers, and 6 business enterprise associations. GAO also analyzed socioeconomic, demographic, and geographic details on EIDL application individuals.